Hi CFA Aspirants, welcome to AMBiPi (Amans Maths Blogs). Are you preparing for CFA Level 1, CFA Level 2 or CFA Level 3 Exam for making a great career in CFA (Charted Financial Analyst) and struggling for Free CFA Level 1 2 3 Mock Exam Practice Test Sample Questions Bank?

Then, you are on the right article out of all over the CFA Study Materials Book and practice questions available on internet. In this article, you will get Free CFA Level 1, 2 and 3 Mock Exam Practice Questions.

So let’s start.

Free CFA Level 1 Mock Exam

Free CFA Level 1 Practice Question No: 1:

Which of the following AIMR Standards states that referral fees must be disclosed in writing to clients or customers?

Option A : V

Option B : VI(A)

Option C : IV (B.8)

Option D : IV

Show/Hide Answer Key

Option C : IV (B.8)

Standard IV (B.8)- Discloser of Referral Fees states: “Members shall disclose to clients and prospects any consideration or benefit received by the member or delivered to other for the recommendation of any services to the client or prospect”.

CFA Level 1 Exam Question No: 2:

Which of the following statements clearly conflicts with the recommended procedure for compliance presented in AIMR’ s standard of practice handbook?

Option A : Investment recommendation may be changed by an analyst without prior approval of a supervisory analyst.

Option B : Prior approval must be obtained for the personal investment transactions of all employees.

Option C : For confidentially reasons, personal transactions should no be compared with those of clients or the employer unless requested by regulatory organizations.

Option D : Personal transactions should be defined as including transactions in securities owned by the employee and member of his or her immediate family and transactions involving securities in which the employee has beneficial interest.

Show/Hide Answer Key

Option C :

This questions deals with the compliance procedure relating to personal investments of members. Employees should compare personal transactions of employees with those clients on a regular basis, regardless of the existence of a regulatory organization. Such comparisons ensure that member’s personal trades do not conflict with their duty to their clients. All the other statements do not conflict with the procedure in the handbook.

Free CFA Level 1 Mock Exam Question No: 3:

Trust Fund is a reasonably successful investment management firm that has as its clients a few pension plans. Trust Fund executes all of its trades with Prime Brokerage, an average brokerage firm. Prime Brokerage charges higher commissions than comparable players in the market but in return, provides investment research on the stocks which are part of the pension plan under assets under Trust Fund’s management. Portfolio managers at Trust Fund know about the close relationship on the golf links between Prime Brokerage’s chief Broker, Ralph Fiennes, and Trust Fund’s CEO, Armis Arvanitis. They also believe that the research provided by Prime Brokerage, while not superlative, is quite useful and justifies the excess expenses in brokerage. This “soft-dollars” practice is disclosed in Trust Fund’s official documents and contracts but Sisko, a freshly minted CFA charter holder, thinks that Trust Fund managers are in violaton of the AIMR code of Ethics.

Which of the following is true?

Option A: Trust Fund’s mangers are violating Standard IV (B.8) – Disclosure of Referral Fees by not revealing the arrangement to pension plan beneficiaries.

Option B: Trust Fund’s managers are violating Standard IV (B.1) – Fiduciary Duties by not executing the trades at the lowest price available.

Option C: Sicko is not applying the AIMR code correctly. Trust Fund’s mangers are not violating any AIMR standards.

Option D : Trust Fund’s managers are violating Standard IV (B.3) – Fair Dealing by unfairly diverting funds from the plan assets to Prime Brokerage through higher fees.

Show/Hide Answer Key

Option C :

The practice of using “soft dollars” (the usage of brokerage for purchase of research services) is not forbidden by the AIMR code or securities laws, as long as they are commensurate with the services received and the practice is disclosed to the clients. In this case, there is no evidence that Trust Fund is overpaying Prime Brokerage or that it is not seeking best price and execution. Hence, Sisko is mistaken and Trust Fund managers are not in violation of the AIMR code.

CFA Level 1 Free Practice Question No: 4:

A financial analyst should conduct himself with ________, competence and dignity and act in an ethical manner in his dealings with the public, clients, customers, employers, employees and fellow analysts.

Option A: integrity

Option B: morality

Option C: none of these answers

Option D: honor

Option E: principal

Show/Hide Answer Key

Option A : integrity

The code of Ethics: “Members of AIMR shall act with integrity, competence, dignity and in an ethical manner when dealing with the public, clients, prospects, employers, employees and fellow members.”

Free CFA Practice Question No: 5:

For ________ of five or fewer portfolios, the disclosure “five or fewer portfolios” may be made rather than a disclosure of the exact number of portfolios.

Option A: returns

Option B: investments

Option C: segments

Option D: composites

Show/Hide Answer Key

Option D : composites

This is an exception allowed by AIMR when disclosing the list of composites.

CFA Level 1 Sample Question No: 6:

According to the AIMR-PPS, terminated portfolios are included in the composite for how long after termination?

Option A: Composites must include terminated portfolios after the last full performance measurement period the portfolios were under management.

Option B: Composites should include the terminated portfolio only until the date of termination.

Option C: Composites should include the terminated portfolio for the last full performance measurement period under which the portfolios were managed.

Option D: Composites should include the terminated portfolio for the full ten years required by the Standards for performance reporting.

Show/Hide Answer Key

Option C :

Composites must exclude terminated portfolios after the last full performance measurement period the portfolios were under management, but composites must continue to include terminated portfolios for all periods prior to termination. This is a requirement for creation and maintenance of composites.

Free CFA Level 1 Quiz Question NO: 7:

Edwards Witten works for Princeton Investments and has registered to take Level III exam nest year. He had taken the Level III exam 3 years ago but was not successful. In this firm’s promotional material, he has stated that he is a candidate in the CFA program and has successfully passed Level II. Edward has

Option A: violated Standard II (A) – Use of Professional Designation. He cannot claim to be in the CFA program without having completed Level III exam.

Option B: violated Standard II (A) – Use of Professional Designation. He cannot claim to be in the CFA program since he failed the Level III exam.

Option C: not violated any standards

Option D: violated Standard II (A) – Use of Professional Designation. He cannot claim to be CFA Level III exam.

Show/Hide Answer Key

Option C :

Use of Professional Designation, states that a person must be registered to take the next higher level of the exam to be a candidate in CFA program. That Edward failed on his last attempt does not prevent him from claiming that he’s a candidate, as long as he has registered for the exam.

CFA Level 1 Test Question No: 8:

According to Standard IV (A.2), members should consider including the following information in research reports, except:

Option A: the methodology that drove the investment decisions.

Option B: yield-to-maturity

Option C: annual amount of income excepted.

Option D: degree of uncertainly associated with the cash flows.

Option E: business, financial, political, sovereign and market risks.

Option F: none of these answers

Option G: degree of marketability / liquidity

Option H: expected annual rate of return.

Show/Hide Answer Key

Option A :

All the information has to be included in the research reports except the methodology that drove the investment decision, which is a part of the maintaining files compliance procedure for Standard IV (A.1)

Free CFA Practice Question No: 9:

The disclosure for retroactive compliance apply to composites formulated prior to _____________.

Option A: January 1989

Option B: January 1992

Option C: January 1991

Option D: January 1993

Option E: January 1990

Show/Hide Answer Key

Option D : January 1990

The effect date to be in compliance with AIMR-PPS was January 1, 1993. Any composites which predate the effective date can be brought into compliance retroactive.

CFA Mock Exam Free Question No: 10:

With regard to real estate, all properties must be included in at least one _________.

Option A: account

Option B: investment type

Option C: composite

Option D: sector

Option E: portfolios

Show/Hide Answer Key

Option C : composite

Consistent with the general requirements for all composite, all properties with discretionary fee-paying investors must be included in at least one account. Because of the unique nature of individual real estate investments, however, composites containing single properties are appropriate in many cases.

Free CFA Level 1 Practice Question No: 11:

Jamie Hutchins, CFA, is a portfolio manager for CNV Investments Inc. Over the years, Hutchins has made several poor personal investments that have led to financial distress and personal bankruptcy. Hutchins feels that her business partner, John Smith, is mostly to blame for her situation since “he did not invest enough money in her investment opportunities and caused them to fail.” Hutchins reports Smith to CFA Institute claiming Smith violated the Code and Standards relating to misconduct. Which of the following statements is correct?

Option A: Neither Hutchins nor Smith violated the Code and Standards

Option B: By reporting Smith to CFA Institute, Hutchins has misused the Professional Conduct Program, thus violating the Code and Standards.

Option C: Hutchins’ bankruptcy reflects poorly on her professional reputation and thus violates the Code and Standards.

Option D: Smith’s lack of investment in Hutchins opportunities violated the priority of transactions, and he was appropriately reported to CFA Institute.

Show/Hide Answer Key

Option B :

Hutchins’ personal bankruptcy may reflect poorly on her professional reputation if it resulted from fraudulent or deceitful business activities. There is no indication of this, however, and the bankruptcy is thus not a violation. Smith has not violated the Code and Standards by refusing to invest with Hutchins in what turned out to be bad investment opportunities. By reporting Smith to CFA Institute for a violation, Hutchins has misused the Professional Conduct Program to settle a dispute unrelated to professional ethics and has thus violated Standard

1(D), Misconduct.

CFA Level 1 Exam Question No: 12:

Which of the following statements most accurately describes the parties that the GIPS standards are intended to apply to and serve? The GIPS standards apply to:

Option A: consultants and serve their existing and prospective clients

Option B: firms that issue securities and serve investment management firms

Option C: investment management firms and serve securities regulatory entities.

Option D: investment management firms and they serve their existing and prospective clients.

Show/Hide Answer Key

Option D :

The GIPS standards apply to investment management firms. They are intended to serve prospective and existing clients of investment firms and consultants who advise these clients.

Free CFA Level 1 Mock Exam Question No: 13:

The amount an investor will have in 15 years if $ 1,000 is invested today at an annual interest rate of 9 percent will be closest to:

Option A: $ 1350

Option B: $ 3518

Option C: $ 3642

Option D: $ 9000

Show/Hide Answer Key

Option C :

N = 15; I/Y = 9; PV = -1,000; PMT = 0; CPT -> FV = $3,642.48

CFA Level 1 Free Practice Question No: 14:

Which of the following statements does NOT accurately describe the internal rate of return (IRR) and net present value (NPV) methods?

Option A: The discount rate that gives an investment an NPV of zero is the investments IRR.

Option B: The IRR is the discount rate that equates the present value of cash inflows with the present value of cash

outflows.

Option C: If the NPV and IRR methods give conflicting decisions for mutually exclusive projects, the IRR decision

should be used to select the project.

Option D: The NPV method assumes that a projects cash flows will be reinvested at the cost of capital, while the

IRR method assumes they will be reinvested at the IRR.

Show/Hide Answer Key

Option C :

If the NPV and IRR methods give conflicting decisions when selecting among mutually exclusive projects, always select the project with the greatest positive NPV.

Free CFA Practice Question No: 15:

The intervals in a frequency distribution should always have which of the following characteristics? The intervals should always:

Option A: be truncated.

Option B: be open ended

Option C: have a width of 10

Option D: be nonoverlapping

Show/Hide Answer Key

Option D :

Intervals within a frequency distribution should always be nonoverlapping and closed ended so that each data value can be placed into only one interval. Intervals have no set width and should be set at a width so that data is adequately summarized without losing valuable characteristics.

Free CFA Level 1 Practice Question No: 16:

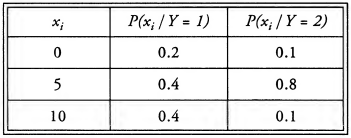

Given the conditional probabilities in the table below and the unconditional probabilities P(Y = 1) = 0.3 and P(Y = 2) = 0.7, what is the expected value of X?

Option A: 4.3

Option B: 5.0

Option C: 5.3

Option D: 5.7

Show/Hide Answer Key

Option C :

E(X|Y = 1) = (0.2)(0) + (0.4)(5) + (0.4)(10) = 6 and E(X|Y = 2) = (0.1)(0) + (0.8)(5) + (0.1)(10) = 5

E(X) = (0.3)(6) + (0.7)(5) = 5.30

Free CFA Level 1 Quiz Question No: 17:

Which of the following is NOT an example of a discrete random variable?

Option A: The number of stocks a person owns.

Option B: The time spent by a portfolio manager with a client

Option C: The number of days it rains in a month in Iowa City.

Option D: The number of people holding Microsoft in their portfolios.

Show/Hide Answer Key

Option B :

Time is usually a continuous random variable; all the others are discrete.

Free CFA Level 1 Practice Question No: 18:

Which of the following most accurately defines a simple random sample? It is a sample

Option A: that includes every tenth element of an arranged population.

Option B: drawn in such a way that each member of the population has some chance of being selected in the

sample

Option C: drawn in such a way that each member of the population has an equal chance of being included in the

sample.

Option D: drawn in such a way that each member of the population has a 1 percent chance of being included in the

sample

Show/Hide Answer Key

Option C :

In a simple random sample, each element of the population has an equal probability of being selected. Choice D allows for an equal chance, but only if there are 100 elements in the population from which the random sample is drawn.

CFA Level 1 Test Question No: 18:

Which of the following statements about hypothesis testing is TRUE?

Option A: A Type II error is rejecting the null when it is actually true.

Option B: The significance level equals one minus the probability of a Type I error

Option C: If the alternative hypothesis is Ha: μ > μ0) the test is a two-tailed test.

Option D: A two-tailed test with a significance level of 5 percent has z-critical values of ±1.96.

Show/Hide Answer Key

Option D :

Rejecting the null when it is actually true is a Type I error. A Type II error is failing to reject the null hypothesis when it is false. The significance level equals the probability of a Type I error. If the alternative hypothesis is Ha: μ > μ0, then the test is a one-tailed test. A two-tailed test would have an alternative hypothesis of Ha: μ ≠ μ0.

Free CFA Practice Question No: 19:

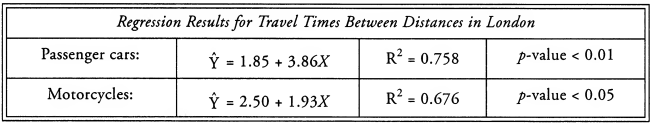

A study was conducted by the British Department of Transportation to estimate urban travel time between locations in London, England. Data was collected for motorcycles and passenger cars. Simple linear regression was conducted using data sets for both types of vehicles, where Y = urban travel time in minutes and X = distance between locations in kilometers. The following results were obtained:

Which of the following is the most accurate estimate of the mean urban travel time for all motorcycles traveling a distance of 3 kilometers on London’s streets?

Option A: 5.71 minutes

Option B: 8.29 minutes

Option C: 17.13 minutes

Option D: 21.15 minutes

Show/Hide Answer Key

Option B :

Motorcycles: yi = 2.50 + 1.93X = 2.50 + 1.93(3) = 8.29 minutes

CFA Mock Exam Question No: 20:

A study was conducted by the British Department of Transportation to estimate urban travel time between locations in London, England. Data was collected for motorcycles and passenger cars. Simple linear regression was conducted using data sets for both types of vehicles, where Y = urban travel time in minutes and X = distance between locations in kilometers. The following results were obtained:

Predict the urban travel time for a particular passenger car traveling a distance of 5 kilometers on London’s streets.

Option A: 12.15 minutes

Option B: 21.15 minutes

Option C: 22.15 minutes

Option D: 28.55 minutes

Show/Hide Answer Key

Option B :

Passenger cars: Yj = 1-85 + 3.86X = 1.85 + 3.86(5) = 21.15 minutes.

Free CFA Level 2 Mock Exam

Free CFA Level 2 Practice Question No: 21:

Jamie Hutchins, CFA, is a portfolio manager for CNV Investments Inc. Over the years, Hutchins has made several poor personal investments that have led to financial distress and personal bankruptcy. Hutchins feels that her business partner, John Smith, is mostly to blame for her situation since “he did not invest enough money in her investment opportunities and caused them to fail.” Hutchins reports Smith to CFA Institute claiming Smith violated the Code and Standards relating to misconduct. Which of the following statements is most likely correct?

Option A: By reporting Smith to CFA Institute, Hutchins has misused the Professional Conduct Program, thus violating the Code and Standards, but her poor investing and bankruptcy have not violated the Code and Standards.

Option B: Hutchins’s bankruptcy reflects poorly on her professional reputation and thus violates the Code and Standards, but her reporting of Smith does not.

Option C: Hutchins’s poor investing and bankruptcy, as well as her reporting of Smith, are both violations of the Standards

Show/Hide Answer Key

Option A :

Hutchins’s personal bankruptcy may reflect poorly on her professional reputation if it resulted from fraudulent or deceitful business activities. There is no indication of this, however, and the bankruptcy is thus not a violation. Smith has not violated the Code and Standards by refusing to invest with Hutchins in what turned out to be bad investment opportunities. By reporting Smith to CFA Institute for a violation,

Hutchins has misused the Professional Conduct Program to settle a dispute unrelated to professional ethics and has thus violated Standard I(D), Misconduct.

CFA Level 2 Exam Question No: 22:

In regards to CPA Institute Soft Dollar Standards, broker selection is a key area of the investment manager’s ability to add value to client portfolios. Which of the following is a requirement in selecting and evaluating brokers? The investment manager must consider:

Option A: the broker’s financial responsibility.

Option B: if the broker is capable of providing best execution

Option C: the range of services provided or offered.

Show/Hide Answer Key

Option C :

The other choices are all recommendations but not requirements. Best execution is the most critical consideration.

Free CFA Level 2 Mock Exam Question No: 23:

Which of the following is least likely an objective for proper implementation of the Research Objectivity Standards?

Option A: Prepare research; make recommendations; take investment actions; and develop policies, procedures, and disclosures that place client interests before employees’ and firm’s interests.

Option B: Support the appropriate regulatory agency regulation by adhering to specific, measurable standards to promote objective and independent research.

Option C: Facilitate full and meaningful disclosures to clients and prospects of possible and actual conflicts of interest of the firm and its employees.

Show/Hide Answer Key

Option C :

Self-regulation is an objective, as opposed to regulation by regulatory agencies. Remember that CFA Institute is a self-regulatory organization.

CFA Level 2 Free Practice Question No: 24:

Which of the following statements regarding the old Prudent Man Rule is most accurate?

Option A: The delegation of investment authority to a third party was acceptable.

Option B: Trustees were to consider the safety of invested assets as well as income potential.

Option C: Each investment was considered in the context of its contribution to the entire portfolio.

Show/Hide Answer Key

Option B :

Delegation of authority was not permitted under the old rule. The trustee was required to consider each investment individually and not in a portfolio context. The old rule has been replaced by the new Prudent Investor Rule.

Free CFA Practice Question No: 25:

Which of the following is not a necessary assumption of simple linear regression analysis?

Option A: The residuals are normally distributed.

Option B: There is a constant variance of the error term.

Option C: The dependent variable is uncorrelated with the residuals.

Show/Hide Answer Key

Option C :

The model does not assume that the dependent variable is uncorrelated with the residuals. It does assume that the independent variable is uncorrelated with the residuals.

CFA Level 2 Sample Question No: 26:

Which of the following situations is least likely to result in the misspecification of a regression model with monthly returns as the dependent variable?

Option A: Failing to include an independent variable that is related to monthly returns.

Option B: Using leading P/E from the previous period as an independent variable.

Option C: Using actual inflation as an independent variable to proxy for expected inflation.

Show/Hide Answer Key

Option B :

Using leading P/E from a prior period as an independent variable in the regression is unlikely to result in misspecification because it is not related to any of the six types of misspecifications previously discussed. We’re not forecasting the past because leading P/E is calculated using beginning-of-period stock price and a forecast of earnings for the next period. Omitting a relevant independent variable from the regression and using actual instead of expected inflation (measuring the independent variable in error) are likely to result in model misspecification.

Free CFA Level 2 Quiz Question NO: 27:

An analyst has determined that monthly sport utility vehicle (SUV) sales in the United States have been increasing over the last ten years, but the growth rate over that period has been relatively constant. Which model is most appropriate to

predict future SUV sales?

Option A: SUVsalest = b0 + b1(t) + er.

Option B: ln(SUVsalest) = b0 + b1(t) + er.

Option C: ln(SUVsalest) = b0 + b1(SUVsalest-1) + er.

Show/Hide Answer Key

Option B :

A log-linear model (choice B) is most appropriate for a rime series that grows at a relatively constant growth rate. Neither a linear trend model (choice A), nor an AR(1) model (choice C) are appropriate in this case

CFA Level 2 Test Question No: 28:

All of the factors below would contribute to an increase in USD/EUR dealer spread except:

Option A: increase in the volatility of EUR/USD spot rate.

Option B: increase in the EUR/USD spread in the interbank market.

Option C: smaller order size.

Show/Hide Answer Key

Option C :

Dealer spreads are lower for smaller orders as compared to larger orders. Dealer spreads are larger when spreads in the interbank market are higher. An increase in spot rate volatility will increase spreads in the interbank market.

Free CFA Practice Question No: 29:

Country X has output elasticity of capital of 0.6 and population growth of 2%. If total factor productivity growth is 1%, what is the sustainable growth rate in output according to neoclassical theory?

Option A: 2.0%

Option B: 2.7%

Option C: 4.5%

Show/Hide Answer Key

Option D : January 1990

The effect date to be in compliance with AIMR-PPS was January 1, 1993. Any composites which predate the effective date can be brought into compliance retroactive.

CFA Mock Exam Free Question No: 30:

Which of the following would least accurately be described as regulation of commerce?

Option A: Antitrust regulations.

Option B: Dispute resolution regulations.

Option C: Prudential supervision regulations.

Show/Hide Answer Key

Option C :

Prudential supervision deals with regulating financial markets rather than regulating commerce. Antitrust regulations and dispute resolution regulations are elements of regulation of commerce

Free CFA Level 2 Practice Question No: 31:

While working on a new underwriting project, Jean Brayman, CFA, has just received information from her client that leads her to believe that the firm’s financial statements in the registration statement overstate the firm’s financial position. Brayman should:

Option A: report her finding to the appropriate governmental regulatory authority

Option B: immediately dissociate herself from the underwriting in writing to the client.

Option C: seek advice from her firm’s compliance department as to the appropriate action to take

Show/Hide Answer Key

Option C :

According to Standard I(A), informing her supervisor or firm’s compliance department is appropriate. Dissociating herself would be premature. She should report her suspicions to a supervisory person and attempt to remedy the situation

Free CFA Level 1 Practice Question No: 32:

JCPA Institute Soft Dollar Standards focus heavily on whether a product or service constitutes “research” that can be paid for with soft dollars (client brokerage) and whether that same product or service provides lawful and proper assistance to the investment manager in carrying out his investment decision making responsibilities. Which of the following statements regarding permissible or allowable “research” is most accurate?

Option A: The product or service should directly assist the investment manager in his investment decision-making process and in the management of the investment firm.

Option B: Determining what is permissible “research” is subject to specific rules.

Option C: CPA Institute recommends performing a three level analysis to assist the investment manager in deciding whether a product or service is “research.”

Show/Hide Answer Key

Option C :

Choice A is incorrect because aid in management of the overall firm is not permissible. Choice B is incorrect because determining what is permissible research is not subject to specific and identifiable rules.

Free CFA Level 2 Mock Exam Question No: 33:

When presenting research and recommendations in a public forum, which of the following would be least likely to comply with the Research Objectivity Standards?

Option A: Firms should require employees to disclose any investment banking relationships or whether the analyst has participated in marketing activities for the subject firm.

Option B: Be sure that the audience can make informed judgments, and provide any supporting research at no cost.

Option C: Be sure that investors consider the investment in the context of their entire portfolio.

Show/Hide Answer Key

Option B :

Any supporting research should be provided at a reasonable cost. The rest of the statements are correct

CFA Level 2 Free Practice Question No: 34:

Which of the following statements is least likely to be a basic principle of the new Prudent Investor Rule?

Option A: Current income for the trust must be balanced against the need for growth.

Option B: Trustees must base appropriateness of risk on an investment’s risk/return profile.

Option C: Trustees may not delegate investment authority, except in unusual circumstances.

Show/Hide Answer Key

Option C :

Trustees are allowed to delegate authority and may, under certain circumstances, be required to delegate authority to perform their fiduciary duty to their clients.

Free CFA Practice Question No: 35:

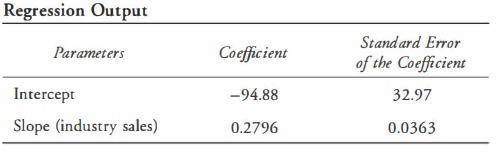

An analyst is interested in predicting annual sales for XYZ Company, a maker of paper products. The following table reports a regression of the annual sales for XYZ against paper product industry sales.

The correlation between company and industry sales is 0.9757. The regression was based on five observations.

Which of the following is closest to the value and reports the most likely interpretation of the R2 for this regression? The R2 is:

Option A: 0.048, indicating that the variability of industry sales explains about 4.8% of the variability of company sales.

Option B: 0.952, indicating that the variability of industry sales explains about 95.2% of the variability of company sales

Option C: 0.952, indicating that the variability of company sales explains about 95.2% of the variability of industry sales.

Show/Hide Answer Key

Option B :

The R2 is computed as the correlation squared: (0.9757)2 = 0.952.

The interpretation of this R2 is that 95.2% of the variation in Company XYZ’s sales is explained by the variation in industry sales. Answer C is incorrect because it is the independent variable (industry sales) that explains the variation in the dependent variable (company sales). This interpretation is based on the economic reasoning used in constructing the regression model.

CFA Level 2 Sample Question No: 36:

An analyst is interested in predicting annual sales for XYZ Company, a maker of paper products. The following table reports a regression of the annual sales for XYZ against paper product industry sales.

The correlation between company and industry sales is 0.9757. The regression was based on five observations.

Based on the regression results, XYZ Company’s market share of any increase in industry sales is expected to be closest to:

Option A: 4%

Option B: 28%

Option C: 45%

Show/Hide Answer Key

Option B :

The slope coefficient of 0.2796 indicates that a $1 million increase in industry sales will result in an increase in firm sales of approximately 28% ($279,600) of that amount.

Free CFA Level 2 Quiz Question No: 37:

An analyst is interested in predicting annual sales for XYZ Company, a maker of paper products. The following table reports a regression of the annual sales for XYZ against paper product industry sales.

The correlation between company and industry sales is 0.9757. The regression was based on five observations.

The analyst determines that the t-statistic is 7.72 and that the correlation coefficient is not significant (using 95% confidence). Is the analyst correct?

Option A: Yes

Option B: No, because the test statistic is 60.93.

Option C: No, because the correlation coefficient is significantly different from zero (using 95% confidence).

Show/Hide Answer Key

Option C :

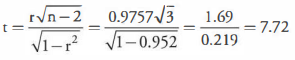

The test of significance for the correlation coefficient is evaluated using the following t-statistic

From the t-table, we find that with df = 3 and 95% significance, the two-tailed critical t-values are ±3.182 (recall that for the t-test the degrees of freedom = n – 2). Because the computed t is greater than +3. 182, the correlation coefficient is significantly different from zero.

CFA Level 2 Test Question No: 38:

Phil Ohlrner is developing a regression model to predict returns on a hedge fund composite index using several different independent variables. Which of the following list of independent variables, if included in the model, is most likely to lead to biased and inconsistent regression coefficients and why?

Option A: Small-cap index returns, high-yield bond index returns, and emerging market index returns; because small-cap returns and hedge fund index returns are likely to be correlated

Option B: Small-cap index returns, high-yield bond index returns, and emerging market index returns; because small-cap returns and emerging market index returns are likely to be correlated

Option C: Small-cap index returns, previous period hedge fund composite index returns, high-yield bond index returns, and emerging market index returns; because the regression model is likely to be misspecified.

Show/Hide Answer Key

Option C :

Including a lagged dependent variable (previous period hedge fund composite index returns) in the list of independent variables is likely to lead to model misspecification and biased and inconsistent regression coefficients.

Free CFA Practice Question No: 39:

What condition is the Durbin-Watson statistic designed to detect in multiple regression, and what is the most appropriate remedy to correct for that condition?

Option A: Condition: Serial correlation Remedy: Use the Hansen method

Option B: Condition: Autocorrelation Remedy: Use generalized least squares

Option C: Condition: Heteroskedasticity Remedy: Use generalized least squares

Show/Hide Answer Key

Option A :

The Durbin-Watson statistic tests for serial correlation of the residuals. The appropriate remedy if serial correlation is detected is to use the Hansen method.

CFA Mock Exam Free Question No: 40:

Qualitative dependent variables should be verified using:

Option A: a dummy variable based on the logistic distribution.

Option B: a discriminant model using a linear function for ranked observations

Option C: tests for heteroskedasticity, serial correlation, and multicollinearity.

Show/Hide Answer Key

Option C :

All qualitative dependent variable models must be tested for heteroskedasticity, serial correlation, and multicollinearity. Each of the alternatives are potential examples of a qualitative dependent variable model, but none are universal elements of all qualitative dependent variable models.

Free CFA Level 3 Mock Exam

Free CFA Level 3 Practice Question No: 51:

In situations where the laws of a member or candidate’s country of residence, the local laws of regions where the member or candidate does business, and the Code and Standards specify different requirements, the member or candidate must abide by:

Option A: local law or the Code and Standards, whichever is stricter.

Option B: the Code and Standards or his country’s laws, whichever are stricter.

Option C: the strictest of local law, his country’s laws, or the Code and Standards.

Show/Hide Answer Key

Option C :

To comply with Standard I(A) Knowledge of the Law, a member must always abide by the strictest applicable law, regulation, or standard.

CFA Level 3 Exam Question No: 52:

Terillium Traders is a small stock brokerage firm that specializes in buying and selling stocks on behalf of client accounts. Several of Terillium’s brokers have recently been placing both a bid and an offer on the same security about two hours before the market opens for trading. This allows their trades to be one of the first ones made after the markets open. Just before the markets open, these brokers would then cancel one of the orders in anticipation that the market

would move in favor of the other order. Which component, if any, of the Asset Manager Code of Professional Conduct has most likely been violated?

Option A: The component dealing with investment process and actions related to market manipulation.

Option B: The Trading section of the Code because this is an example of “frontrunning” client trades.

Option C: Loyalty to Clients, the section pertaining to placing client interests before their own.

Show/Hide Answer Key

Option A :

This is an example of market manipulation that is part of the Investment Process and Actions section of the Code. By placing trades in anticipation of the market and getting preferential treatment in getting their trades placed first, Terillium is distorting the market process and, thus, manipulating the market. Front-running is when a trade is placed based on information that a large transaction will take place that could affect the price of a security, and the trader is attempting to profit based on this information. Loyalty to Clients, specifically placing client interests before your own, deals with aligning manager interests with client interests and avoiding situations in which they would conflict, such as inappropriate compensation arrangements

Free CFA Level 3 Mock Exam Question No: 53:

An investor has ranked three investments and labeled them as A, B, and C. He prefers investment A to investment B and investment B to investment C. Not being able to rank investment A relative to investment C would most likely violate which of the four axioms of utility?

Option A: Continuity.

Option B: Dominance.

Option C: Transitivity.

Show/Hide Answer Key

Option C :

According to transitivity, investment rankings must be applied consistently. If an investor prefers investment A to investment B and prefers investment B to investment C, he must prefer investment A to investment C. Continuity is the axiom of utility that must apply for indifference curves to be smooth and unbroken (continuous). Dominance has two, similar meanings. In portfolio theory, dominance is a characteristic of portfolios on the efficient frontier (EF). Portfolios on the EF are said to dominate any portfolio below the efficient frontier. In a similar fashion, during the editing phase of prospect theory, an investor will eliminate any investment opportunity he perceives as being dominated by others.

CFA Level 3 Free Practice Question No: 54:

Which of the following would most likely be classified as an emotional bias? The investor:

Option A: has difficulty interpreting complex new information.

Option B: only partially adjusts forecasts when he receives new information

Option C: has a tendency to value the same assets higher if he owns them than if he does not own them.

Show/Hide Answer Key

Option C :

This describes the endowment bias, where individuals place a higher value on assets they own than if they did not own those same assets. The other two answer choices describe cognitive errors that are due to the inability to analyze all the information.

Free CFA Practice Question No: 55:

Which of the following is least indicative of the pyramid structure seen when individuals create portfolios?

Option A: The correlation between the assets in the pyramid is ignored.

Option B: Individuals subconsciously view the pyramid as having a single level of risk.

Option C: People tend to place their money into different “buckets,” which is referred to as mental accounting

Show/Hide Answer Key

Option B :

In the pyramid structure, investors view each separate layer or investment within that layer as having a separate level of risk associated with the goal they are trying to accomplish with that investment. It is in the traditional finance theory approach of portfolio construction where all the investor’s assets are viewed as one complete portfolio with a single level of risk. In the pyramid structure, the correlation between the assets in the pyramid is ignored, whereas in the traditional finance portfolio construction, the correlation between the asses is taken into consideration. In the pyramid structure, individuals tend to think of each layer separately, which is referred to as mental accounting.

CFA Level 3 Sample Question No: 56:

According to principles of the behavioral finance investment framework, loss aversion would most Likely lead an investor to:

Option A: fully adjust expectations to new information as it arrives.

Option B: prefer to take a small loss rather than take a risk with a potential but not certain larger loss.

Option C: prefer to take a risk with a potential but not certain larger loss than take a certain small loss.

Show/Hide Answer Key

Option C :

Loss aversion means investors prefer uncertain losses to smaller certain losses. Rather than give up and take a small loss, investors would rather take their chances with a larger loss, as long as there is still the possibility of a gain. These investors will tend to hold losing investments too long.

Free CFA Level 3 Quiz Question NO: 57:

Of the seven primary global tax regimes, determine which of the following does not provide potentially favorable tax treatment of interest income.

Option A: The Flat and Heavy regime.

Option B: The Common Progressive regime.

Option C: The Light Capital Gain Tax regime.

Show/Hide Answer Key

Option B :

The Light Capital Gain Tax regime provides potentially favorable treatment for capital gains but not for interest and dividend income. The Flat and Heavy regime provides potentially favorable treatment for interest income but not capital gains and dividend income. The Common Progressive regime provides potentially favorable treatment for interest income, dividend income, and capital gains.

CFA Level 3 Test Question No: 58:

Which of the following are the main objectives of estate planning and the results of the techniques used to facilitate those objectives? The main objectives of estate planning are to minimize taxes and:

Option A: achieve effective diversification. The results of the techniques used can include tax efficiency, access to assets to be transferred, and control over those assets.

Option B: transfer assets to heirs or recipients of charitable bequests in an efficient manner. The results of the techniques used can include asset protection from creditors, creating liquidity, and transferring assets for a specific purpose.

Option C: transfer assets to heirs or recipients of charitable bequests in an efficient manner. The results of the techniques used can include tax efficiency, access to assets to be transferred, control over the management of those assets, and the ability to maximize excess returns.

Show/Hide Answer Key

Option B :

The primary objectives of estate planning are to minimize taxes and to facilitate the tax efficient transfer of assets to heirs or recipients of charitable bequests. Diversification and the ability to maximize excess returns are usually not the objectives of estate planning and are part of the grantor’s! settlor’s investment policy statement while accumulating assets throughout working years and throughout retirement.

Free CFA Practice Question No: 59:

According to capital market theory, there are two fundamental types of risk for an investor holding equity securities. These are:

Option A: concentrated, non-concentrated.

Option B: systematic, non-concentrated.

Option C: systematic, non-systematic.

Show/Hide Answer Key

Option C :

According to capital market theory, there are two fundamental types of risk for an investor holding equity securities: systematic or market-based risk, and non-systematic or firm-specific risk.

CFA Mock Exam Free Question No: 60:

When measuring human capital, the individual’s expected inflows should include all of the following EXCEPT:

Option A: expected bonuses

Option B: dividends that are consumed rather than reinvested.

Option C: the post-retirement pension.

Show/Hide Answer Key

Option B :

The cash flows included in measuring the individual’s human capital should include all cash flows generated through employment, including employment-related pensions. Earnings (dividends and interest) on investments are considered financial capital, whether consumed or reinvested. Consuming them, however, decreases the growth in the individual’s financial capital.

Free CFA Level 3 Practice Question No: 61:

According to the Standard on independence and objectivity, members and candidates:

Option A: may accept gifts or bonuses from clients.

Option B: may not accept compensation from an issuer of securities in return for producing research on those securities.

Option C: should consider credit ratings issued by recognized agencies to be objective measures of credit quality

Show/Hide Answer Key

Option A :

Gifts from clients are acceptable under Standard I(B) Independence and Objectivity, but the Standard requires members and candidates to disclose such gifts to their employers. Standard I(B) allows issuer-paid research as long as the analysis is thorough, independent, unbiased, and has a reasonable and adequate basis for its conclusions, and the compensation from the issuer is disclosed. Members and candidates should consider the potential for conflicts of interest inherent in credit ratings and may need to do independent research to evaluate the soundness of these ratings..

CFA Level 3 Exam Question No: 62:

Bill Cooper finds a table of historical bond yields on the Web site of the U.S. Treasury that supports the work he has done in his analysis and includes the table as part of his report without citing the source. Has Cooper violated the Code and Standards?

Option A: Yes, because he did not cite the source of the table.

Option B: Yes, because he did not verify the accuracy of the information.

Option C: No, because the table is from a recognized source of financial or statistical data.

Show/Hide Answer Key

Option C :

According to Standard I(C) Misrepresentation, members and candidates must cite the sources of the information they use in their analysis, unless the information is factual data (as opposed to analysis or opinion) from a recognized financial or statistical reporting service. The U.S. Treasury is one example of a recognized source of factual data.

Free CFA Level 3 Mock Exam Question No: 63:

Which of the following statements about the Standard on misconduct is most accurate?

Option A: Misconduct applies only to a member or candidate’s professional activities.

Option B: Neglecting to perform due diligence when required is an example of misconduct.

Option C: A member or candidate commits misconduct by engaging in any illegal activity.

Show/Hide Answer Key

Option B :

Failing to act when required by one’s professional obligations, such as neglecting to perform due diligence related to an investment recommendation, violates Standard I(D) Misconduct. Acts a member commits outside his professional capacity are misconduct if they reflect poorly on the member or candidate’s honesty, integrity, or competence (e.g., theft or fraud). Violations of the law that do not reflect on the member or candidate’s honesty, integrity, or competence (e.g., an act related to civil disobedience) are not necessarily regarded as misconduct. .

CFA Level 3 Free Practice Question No: 64:

Ed Ingus, CFA, visits the headquarters and main plant of Bullitt Company and observes that inventories of unsold goods appear unusually large. From the CFO, he learns that a recent increase in returned items may result in earnings for the current quarter that are below analysts’ estimates. Based on his visit, Ingus changes his recommendation on Bullitt to “Sell.” Has Ingus violated the Standard concerning material nonpublic information?

Option A: Yes

Option B: No, because the information he used is not material.

Option C: No, because his actions are consistent with the mosaic theory.

Show/Hide Answer Key

Option A :

The statement from the CFO about the current quarter’s earnings is material nonpublic information. Ingus violated Standard II(A) Material Nonpublic Information by acting or causing others to act on it..

Free CFA Practice Question No: 65:

Green Brothers, an emerging market fund manager, has two of its subsidiaries simultaneously buy and sell emerging market stocks. In its marketing literature, Green Brothers cites the overall emerging market volume as evidence of the

market’s liquidity. As a result of its actions, more investors participate in the emerging markets fund. Green Brothers most likely:

Option A: did not violate the Code and Standards.

Option B: violated the Standard regarding market manipulation.

Option C: violated the Standard regarding performance presentation.

Show/Hide Answer Key

Option B :

The intent of Green Brothers’ actions is to manipulate the appearance of market liquidity in order to attract investment to its own funds. The increased trading activity was not based on market fundamentals or an actual trading strategy to benefit investors. It was merely an attempt to mislead market participants in order to increase assets under Green Brothers’ management. The action violates Standard II(B) Market Manipulation.

CFA Level 3 Sample Question No: 66:

Cobb, Inc., has hired Jude Kasten, CFA, to manage its pension fund. The client(s) to whom Kasten owes a duty of loyalty are:

Option A: Cobb’s management

Option B: the shareholders of Cobb, Inc.

Option C: the beneficiaries of the pension fund.

Show/Hide Answer Key

Option C :

Standard III(A) Loyalty, Prudence, and Care specifies that for the manager of a pension or trust, the duty of loyalty is owed to the beneficiaries, not to the individuals who hired the manager.

Free CFA Level 3 Quiz Question No: 67:

Which of the following actions is most likely a violation of the Standard on fair dealing?

Option A: A portfolio manager allocates IPO shares to all client accounts, including her brother’s fee-based retirement account

Option B: An investment firm routinely begins trading for its own account immediately after announcing recommendation changes to clients.

Option C: After releasing a general recommendation to all clients, an analyst calls the firm’s largest institutional clients to discuss the recommendation in more detail.

Option D: Smith’s lack of investment in Hutchins opportunities violated the priority of transactions, and he was appropriately reported to CFA Institute.

Show/Hide Answer Key

Option B :

The firm must give its clients an opportunity to act on recommendation changes. Firms can offer different levels of service to clients as long as this is disclosed to all clients. The largest institutional clients would likely be paying higher fees for a greater level of service. The portfolio manager’s brother’s account should be treated the same as any other client account. .

CFA Level 3 Test Question No: 68:

The Standard regarding suitability most likely requires that:

Option A: an adviser must analyze an investment’s suitability for the client prior to recommending or acting on the investment

Option B: a member or candidate must decline to carry out an unsolicited transaction that she believes is unsuitable for the client.

Option C: when managing a fund to an index, a manager who is evaluating potential investments must consider their suitability for the fund’s shareholders.

Show/Hide Answer Key

Option A :

According to Standard III(C) Suitability, a member or candidate who is in an advisory relationship with a client is responsible for analyzing the suitability of an investment for the client before raking investment action or making a recommendation. A member or candidate who believes an unsolicited trade is unsuitable for the client can either decline to carry it our or ask the client to provide a statement that suitability is not a consideration for this trade. When managing a fund to an index or stared mandate, the manager is responsible for ensuring that potential investments are consistent with the fund’s mandate. Suitability for individuals would be a concern for an adviser who recommends the fund to clients, bur nor for the manager of the fund.

Free CFA Practice Question No: 69:

Which of the following is most likely a recommended procedure for complying with the Standard on performance presentation?

Option A: Exclude terminated accounts from past performance history.

Option B: Present the performance of a representative account to show how a composite has performed.

Option C: Consider the level of financial knowledge of the audience to whom the performance is presented.

Show/Hide Answer Key

Option C :

Recommendations stared in Standard 111(0) Performance Presentation include considering the sophistication and knowledge of the audience when presenting performance data. Other recommendations are to include terminated accounts from past performance history; to present the performance of a composite as a weighted average of the performance of similar portfolios, rather than using a single representative account; and to maintain the records and data that were used to calculate performance.

CFA Mock Exam Free Question No: 70:

The CFA Institute Professional Conduct Program (PCP) has begun an investigation into Chris Jones, a Level II CFA candidate, and a number of his CFA Charter holder colleagues. Jones has access to confidential client records that could be useful in clearing his name, and he wishes to share this information with the PCP. Which of the following most accurately describes Jones’s duties with regard to preservation of confidentiality?

Option A: Sharing the confidential information with the PCP would violate the Standards

Option B: The Standards encourage, but do not require, that Jones support the PCP investigation into his colleagues

Option C: Jones may share confidential information about former clients with the PCP but may not share confidential information about current clients

Option D: Smith’s lack of investment in Hutchins opportunities violated the priority of transactions, and he was appropriately reported to CFA Institute.

Show/Hide Answer Key

Option B :

Members and Candidates are required tO cooperate with PCP investigations into their own conduct, and they are encouraged to cooperate with PCP investigations into the conduct of others. Sharing confidential information with the PCP is nor a violation of Standard III(E) Preservation of Confidentiality. Any client information shared with the PCP will be kept in strict confidence. Standard III(E) stares that members and candidates are required to maintain confidentiality of client records even after the end of the client relationship.